Trump praises Germany's negative yields but doesn't mention that its bond sale failed

President Donald Trump answers questions from reporters as he meets with Romania's President Klaus Iohannis in the Oval Office of the White House in Washington, August 20, 2019.

Kevin Lamarque | Reuters

President Donald Trump lauded Germany's ability to sell bonds with no interest Wednesday, but he didn't mention that Germany failed to sell more than half of what it brought to auction.

The German government sold 869 million euros of 30-year bonds with a negative yield, for the first time ever, adding to the world's growing $15 trillion in existing negative yielding debt.

The bund, set to mature in 2050, has a zero coupon, meaning it pays no interest. Germany offered 2 billion euros worth of 30-year bunds, and investors were willing to buy less than half of it, with a yield of minus 0.11%.

Trump said Germany was able to get investors to pay it for its debt, while the U.S. is a "more important" credit but must pay interest. "WHERE IS THE FEDERAL RESERVE?" Trump asked in the tweet, in his latest criticism of the Fed and Fed Chairman Jerome Powell.

"It remains to be seen whether this is the beginning of some push back on the part of investors to this insanity of negative rates. We'll have to see for now," said Peter Boockvar, chief investment strategist at Bleakley Advisory Group. "'People said 'I can't buy this,' so that's why they sold less than half of what they were hoping for ... They were hoping to sell 2 billion euros worth. That's why we call it a failed auction."

Boockvar said Trump should take a harder look at Europe, where the European Central Bank is expected to soon resort to cutting rates to even more negative levels and other forms of asset purchase stimulus.

"He should look at their bank stocks. Wanting to emulate the European banking system, which has choked on negative rates, is not well thought-out," he said.

Ian Lyngen, head of U.S. rates at BMO, said the German government was forced to buy the remaining bonds itself Wednesday, a pattern that is common for Berlin. "It was technically an uncovered auction, which means the German government needed to buy a reasonable portion of it," said Lyngen.

Andy Brenner of National Alliance said Germany has held failed auctions in the past but that this was the worst.

"This is the most significant I've seen in terms of a failed 30-year. For the Bundesbank to take 60% is unprecedented. There was no demand for 30-year paper at negative interest rates. They only could sell about 40% of it. A real investor can't make pension payments based on negative interest rates," he said.

It is the negative yields and shockingly low rates elsewhere in the world that have been sending investors into the U.S. bond market in a hunt for safe investments with a yield. As a result, U.S. Treasury yields, which move opposite price, have fallen sharply, making loans cheaper for American businesses and consumers, including on home mortgages.

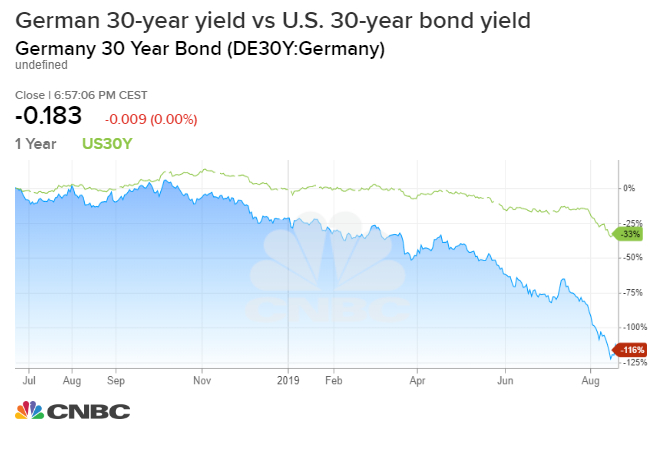

The German auction comes during a month when rates have fallen sharply and German yields plumbed deeper into negative territory. U.S. yields also fell into record territory, with the U.S. 30-year reaching a record low of 1.91% last week.

About a third of the world's trade-able bonds now have negative yields.

"Modestly negative policy rates had perhaps a positive overall impact initially, but keeping rates in very negative territory for prolonged periods or navigating to even deeper negative territory could unleash more unintended consequences than benefits," wrote J.P. Morgan strategists this week.

The U.S. Treasury will be relying on investors' appetite for U.S. debt, as the government issues more and more bonds to pay for its deficit. Germany, meanwhile, had a record budget surplus of 58 billion euros last year, its fifth record surplus in a row, though it is considering a spending program.

"The last 30-year Treasury auction tailed 1.1 basis points. However, there was strong non-dealer awards at 74.9% versus the average of 69.6%. That is not inconsistent with the notion that more end users are buying Treasurys over the comparable European investable alternatives, " said Lyngen.

The U.S. market makes up 50% of the investment grade universe, up from 40% a decade a ago, notes Deutsche Bank Securities chief economist Torsten Slok.

"With negative interest rates in Europe and Japan, European real money managers and Japanese banks are forced to hunt yield to deliver steady returns. For regulatory reasons, they are mainly allowed to buy investment grade sovereign bonds and investment grade corporate bonds," wrote Slok, in a note.

It's unclear how disruptive it will be for the global bond market when investors change their view on the need for super low or negative rates.

"Unfortunately, it may take a banking crisis in Japan and Europe for them to wake up to the poison that negative rates are for their banks," Boockvar said.

Trump has also criticized the European Central Bank for its easy policies, which he says gives it a weaker currency and an edge against the U.S.

But J.P. Morgan economists point out the ECB's negative rates policy hasn't helped all that much.

"The initial evidence on credit creation from the Euro area was mixed at best ... net credit creation in the Euro area declined sharply during the Euro area crisis and remained weak even as the ECB pushed deposit rates to -20bp in 2014," they noted. "It subsequently recovered, though to fairly muted growth rates by historical standards. And pushing deposit rates further into negative territory at the Dec15 and Mar16 meetings did not appear to boost lending growth rates further."

—Correction: An earlier version of this story misstated the size of Germany's 30-year bund offering.

Read More

No comments