Twitter stock plunges as company blames ad targeting problems for earnings miss

Twitter shares dropped as much as 20% Thursday after the company reported a third quarter plagued by product issues and advertising "headwinds."

Platform bugs weighed on revenue and ultimately led the company to an earnings miss on the top and bottom lines.

Here's what the company reported, compared with what Wall Street analysts were expecting, according to Refinitiv consensus estimates:

- Earnings per share: 17 cents, vs. 20 cents expected

- Revenue: $823.7 million, vs. $874.0 million expected

- Monetizable daily active users: 145 million

The company cited "a number of headwinds" in its revenue shortfall, including product issues and lower-than-expected advertising in July and August.

"In Q3 we discovered, and took steps to remediate bugs that primarily affected our legacy Mobile Application Promotion (MAP) product, impacting our ability to target ads and share data with measurement and ad partners," the company said in its shareholder letter. "We believe that, in aggregate, these issues reduced year-over-year revenue growth by 3 or more points in Q3."

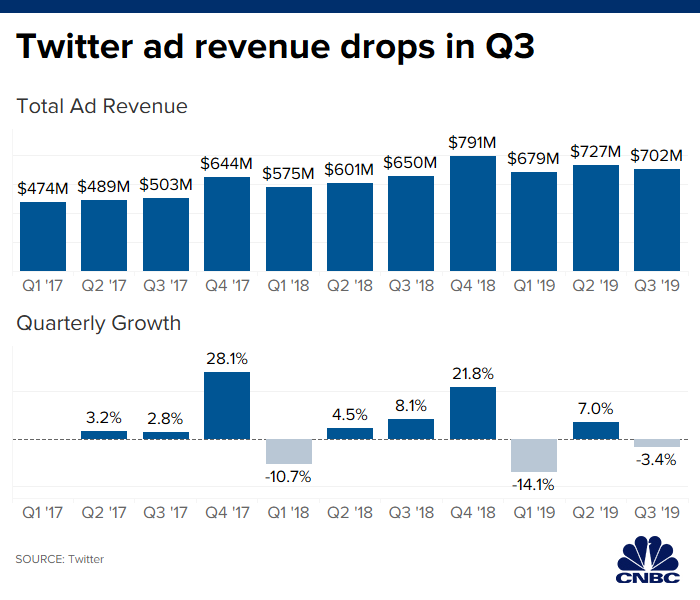

Advertising revenue for the quarter came in at $702 million, 8% higher than a year earlier but significantly lower than the $756 million in ad revenue that analysts surveyed by FactSet had predicted.

Total ad engagements increased 23% year over year, and cost per engagement dropped 12%.

Limiting ad targeting

Chief Financial Officer Ned Segal outlined several issues with the company's advertising systems during the earnings conference call.

"These came up over the course of the quarter, and it wasn't one particular day — there were more than one of these things," CFO Ned Segal said on the company's earnings call.

In one particular bug, a new user to Twitter was asked whether the platform could use device-specific settings to personalize the user's timeline. The platform collected that data, even when the user responded "no" to the prompt. The company realized the improper use of user data and shut off the feature entirely, limiting its ability to target and sell ads.

The company also saw an issue with reporting user data to advertising partners. Twitter, which allows users to opt out of having their data shared with advertisers, was "passing on data which we had not intended to," Segal said on the earnings call.

"This wasn't one thing. There were things that we found out over the course of the quarter, and when you get a full quarter's impact of them, even if you're working to remediate, there can be negative impact to revenue," Segal said.

The data-related issues and limited ad capabilities amount to lower prices for Twitter ads, which the company sells through an auction system.

"We run an auction, and so advertisers decide how much to pay for the audience that they want to target with their ads. And the more that you know about what somebody might want to see, the more compelling an ad or the more relevant an ad you can show them," Segal told CNBC's "Squawk Box" following the earnings report.

"When you have to change the inputs that an advertiser can use to assess how much they might pay in an auction, sometimes they will hold back on the advertising, sometimes they will choose to pay less, sometimes they will choose to target different people," Segal said.

The company warned shareholders that the headwinds, which were felt for only part of the third quarter, will be felt for the entirety of the fourth quarter and will "continue to weigh on the overall performance of our advertising business in the near term."

As a result, Twitter is guiding toward lighter-than-expected fourth-quarter revenue. The company expects to bring in revenue of $940 million to $1.01 billion — just shy of the $1.06 billion that analysts surveyed by Refinitiv had forecast.

Segal warned the impacts could "bleed over" into 2020 as well.

Before the earnings report, Twitter shares were up 35% in 2019, with a market cap just above $30 billion. Thursday's stock move shaves roughly $6 billion off the company's market cap.

Growing the platform

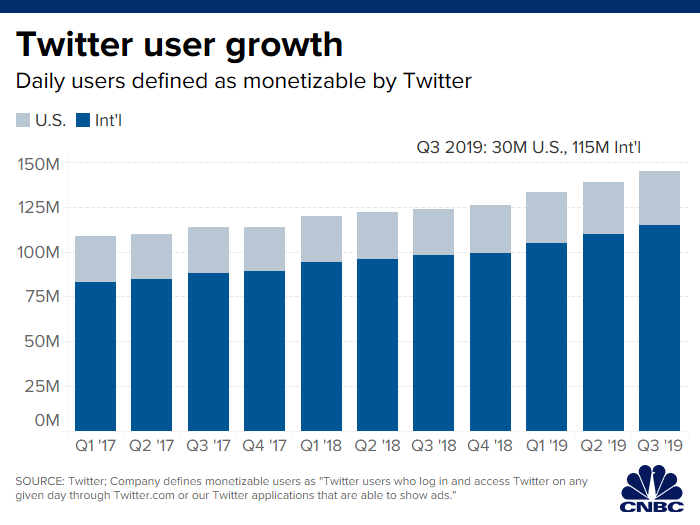

Last quarter, Twitter did away with reporting monthly active users and shifted to a new growth metric — monetizable daily active users (mDAUs) — to measure the daily active users who are shown ads on the platform.

The 145 million mDAUs that Twitter reported for the third quarter is a 4% increase from the second quarter of 2019, when the company reported 139 million mDAUs, and a 17% increase year over year.

Twitter said the "monetizable" distinction is why its mDAUs fall short of the total daily active users of social media rivals like Snap and Facebook, which boast 203 million and 1.59 billion DAUs, respectively.

"Despite its challenges, this quarter validates our strategy of investing to drive long-term growth," Segal said in a statement. "More work remains to deliver improved revenue products. We'll continue to prioritize our ad products along with health and our investments to drive ongoing growth in mDAU."

Twitter's quarterly expenses grew 17% during the period, to $780 million, in part due to hiring and investment in sales, marketing, and research and development. The company ended the quarter with 4,600 employees, 300 more than at the end of the second quarter.

The company expects to keep spending. For fiscal 2019, Twitter is predicting capital expenditures to come in at $550 million to $600 million, a big hike from $487 million a year earlier.

Correction: This story has been updated to correct the quarter during which Twitter reported 139 million monetizable daily active users. That report came during the second quarter of 2019.

Read More

No comments