JC Penney CEO rolls out 'sound' strategies, but there's only so much time to turn around sales

J.C. Penney doled out more detail about its plans to try to turn things around at the struggling department store chain. But the reality is in the numbers. And Penney's sales are still falling, as the retailer continues to lose money.

Penney only has so much time to try to win customers back, and to keep existing ones coming to its shops. It's not as if shoppers don't have plenty of places to choose from for their clothes, home furnishings and makeup today, including online. And traffic continues to drop off at America's outdated shopping malls.

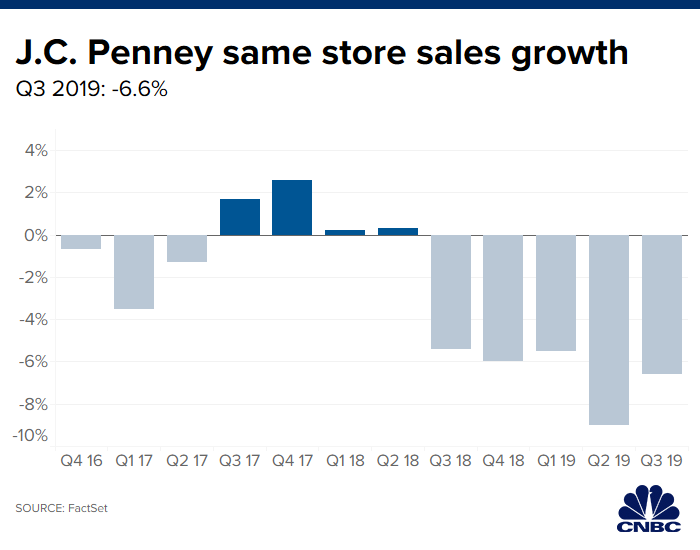

Penney is calling for sales to be down 7% to 8% in fiscal 2019. It hasn't reported a quarterly sales gain since the 2017 holiday season. It has teetered between sales declines and growth over the past decade, reporting a drop in annual sales of 6.6% last year, compared with a 2.6% gain the year prior.

CEO Jill Soltau told analysts on Friday morning, "We know we need to deliver something different," for 117-year-old Penney to be around for another 117 years. Penney especially wants to avoid the fate of bankrupted Sears.

"Looking ahead, management laid out a thoughtful strategy, in our opinion, to restore JCPenney," Gordon Haskett analyst Chuck Grom said in a note to clients. "Favorably, unlike some of Jill Soltau's predecessors, she seems to want to embrace the core JCPenney shopper for who that is ... rather than attempt to trade-up."

"Indeed, focusing on visual merchandising [such as store displays] and driving traffic are sound strategies, but will take time," he said.

Investors sent J.C. Penney shares up about 6% Friday, to trade around $1.16. The stock, which has been at risk of being delisted from the NYSE, has risen about 5% this year, pushing it back above $1. It has a market cap of just $376.6 million, compared with Macy's $5.2 billion.

The company reported a narrower-than-expected quarterly loss for its fiscal third quarter and said some of its turnaround initiatives, such as adding better apparel displays in stores and putting mannequins back in the women's departments, are taking hold. It also raised its expectations for adjusted earnings before interest, taxes, depreciation and amortization for the current fiscal year.

You can get a small taste of what Penney is testing at a recently opened store in Hurst, Texas, which the company refers to as a "brand-defining" space. Some unique additions to the first-of-its-kind location include a barber shop, a kids play area, a cafe, a "selfie studio" and styling rooms for men and women. There also are fitness studios and styling classes.

"A brand-defining store is not a prototype to roll out across all our stores, and it is not a flagship store," Soltau explained. "Our brand-defining store is the fullest articulation of our customer strategy. It is a store where we can leverage learnings from customer feedback, yet also observe customer preferences and shopping behaviors."

It's hard to say if this will really move the needle for Penney, however. Especially if aspects of this space don't end up in the retailer's more than 800 other locations across the country — some of which are in poorer shape than others.

Some might go as far as likening Penney's troubles to where Sears was a few years back, though Sears had seen more consecutive sales declines and had a more troubled balance sheet. Sears tried things like opening small-format shops, shuttering unprofitable locations and selling off brands. But those efforts weren't enough to avoid the path to bankruptcy.

Penney doesn't have a major debt repayment due until 2023, and it has been talking with its creditors to ease its debt load. There is only so much time for it to right the ship.

On Friday, CFO Bill Wafford said the company is "taking positive and proactive measures to enhance our capital structure" and that Penney has "very manageable near-term debt maturities."

Meanwhile, some analysts were expecting Penney might announce additional store closures on Friday, but that wasn't the case.

"I have not given any direction on what we're doing with our fleet closing or keeping open," Soltau told analysts. "All I've said is that we are very close to our physical fleet and understanding what each store is contributing to the total business, as it relates to driving traffic."

Penney had said in February that it expects to close 18 department stores and nine home and furniture shops in 2019.

Although this holiday season offers Penney a chance to prove it can drive traffic to stores at the most crucial time of year, most shoppers who walk through its doors won't be able to experience the new ideas it is trying out.

The company said it has made progress moving away from some "unprofitable promotions," which have weighed on gross margins. Faced with a shorter holiday season this year, which has prompted some retailers to kick off deals even earlier, Soltau said, "We know that the holidays can be a frantic time, and we don't want to contribute to that. We want to do just the opposite."

Read More

No comments